Crane rental confidence 2023 survey results

31 January 2023

ICST asked companies to complete its annual crane confidence survey to identify the key trends and core issues affecting the industry, and the results are surprising. Niamh Marriott reports.

Photo: AdobeStock

Photo: AdobeStock

Following the data can always lead to the right conclusions and we would like to thank every respondent who took part in our digital collation of information in this year’s survey.

It helps us to establish a bigger picture of what’s going on, and in turn can help you, the reader, benchmark your business and understand the major players and emerging trends set to break through this year.

Global crane market confidence

The data we have collected is from a wide range of crane rental businesses based all over the world so that we can build a global picture of the industry in general.

It’s important to note from the start - the majority of responders to our rental confidence survey this year base their business operations or headquarters in North America, and that this may affect the results overall.

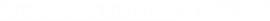

70% of respondents believe business activities improved in 2022.

70% of respondents believe business activities improved in 2022.

The USA is an enormous market for the crane and transport industries, and certainly one to watch as the world moves into post-pandemic environment.

As expected, we have also had a large response from Europe, Asia Pacific and the Middle East, as well as new information from emerging markets in Africa and South America.

Construction is booming globally, and a key factor in the countries’ economic recovery. We also have received little reporting from Australia and New Zealand this year, but have reported on several large projects in that area over the last 12 months on our website, as well as in the magazine.

Make sure to check our website regularly for updates on international news.

It would be helpful to bear in mind this global split when reviewing the results, to ensure a clear perspective, and to be aware of any bias that might have been formed.

Are business conditions improving?

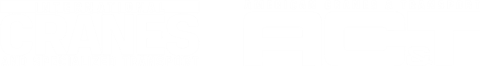

Most respondents said they believe business cnditions are remaining stable.

Most respondents said they believe business cnditions are remaining stable.

When it comes to business conditions, a large portion of people, over 35%, responded that they see conditions improving generally, with half suggesting that things are at least stable, a confident statistic to behold when comparing to last year.

For the 2021 survey, nearly 24% commented that business conditions were deteriorating; that figure is reduced this year to 15%.

Of course, it would be better if conditions were improving across the board, but a sense of stability is just what is needed after such a turbulent time.

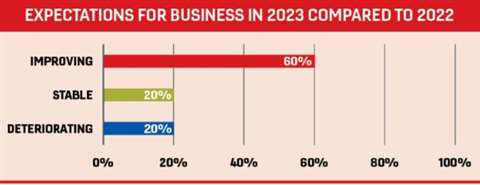

Future expectations for crane rental

When asked about 2022 business activity in comparison to 2021, 70% of responders said it was an improvement and not a single company said it deteriorated from the previous year, a hugely encouraging sign.

It’s not necessarily the same picture when it comes to future predictions, with several companies anticipating some deterioration from 2022 as we move into the new year.

Perhaps this is just our responders being a little conservative in their estimates, a cautious return to normality.

60% of the survey are anticipates an improvement this year.

60% of the survey are anticipates an improvement this year.

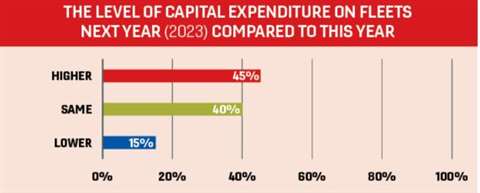

Capital expenditure increase for crane rental companies

When it comes to spending, nearly half of respondents will have a higher capital expenditure and intend to make bigger investments in 2023, compared to last year.

The survey indicated that over 40% will have the same amount of expenditure this year.

The ways in which companies expand and improve their fleets are varied, but maintenance and modernisation are increasingly becoming a large part of this.

45% of people who responded to the survey said the level of capital expenditure on fleets this year will increase.

45% of people who responded to the survey said the level of capital expenditure on fleets this year will increase.

There are still some cautious and more modest crane rental companies who intend to have lower capital expenditure, with just over 15 per cent intending to streamline and have a lower capital expenditure this year.

Staffing surge

It’s a slightly brighter picture when looking at employee changes rather than machinery or expenditure.

Well over half of respondents said that they intend to increase staff numbers as the industry attempts to cope with skills shortages and the need for a diverse workforce.

Most of the responses claim to be increasing the number of employees in 2023.

Most of the responses claim to be increasing the number of employees in 2023.

Encouraging young people to the industry is an ongoing challenge and many companies are working out how to attract young talent.

Nearly 40% said that they wouldn’t be making any changes and just 5% said they intend to reduce numbers of people working for their organisations.

This is far more positive than last year’s survey when 12% of respondents indicated they would be reducing overheads by cutting staff, demonstrating the pressures to staffing due to the pandemic.

Moving forward, it should be considered that in some cases it is likely the reduction will be involuntary and as a result of not being able to find enough suitable people.

Dramatic staff changes and unfortunate redundancies have been seen not only in the crane sector but across the majority of industries, and it is only now that we are starting to see improvements.

One survey respondent agreed and said, “Crane rental in our market is strong given the winter season and typical slow down that hasn’t been seen since pre Covid.

Demand is strong, but our growth is dependent upon hiring more team members and finding good used equipment. Both of which are causing that growth to be tempered.”

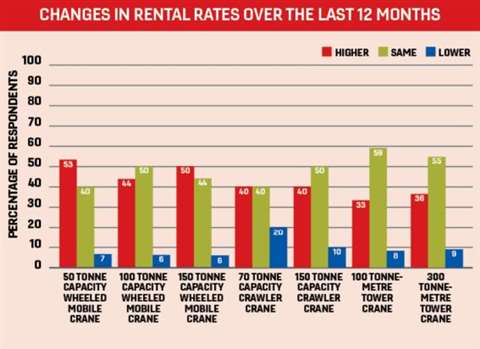

Changes to crane rental rates

Rental rates have been in flux over the last few years and this year’s figures offer a sense of the current state of play.

We look at the rates for 50, 100 and 150 tonne capacity wheeled mobile cranes, 70 and 150 tonne capacity crawler cranes and 100 and 300 tonne-metre tower cranes to get a glimpse of the overall situation.

In the last 12 months, 53.3% of companies have increased their rates for 50 tonne mobile cranes, 43.7% for 100 tonnes and 50% for 150 tonne capacities.

When it comes to crawlers, over 40% of companies increased their rates for both 70 and 150 tonne capacity models.

It’s a more moderate increase for tower cranes, with 33 and 36% of companies increasing their rates for 100 and 300 tonne-metre machines, respectively.

Looking ahead to the next 12 months shows equally promising predications. Mobile crane rates are forecasted to increase with 46.6% of companies increasing rates on 50 tonne models, 43.75% on 100 tonners and 50% for 150 tonne capacity cranes.

It’s a similar story when it comes to crawler cranes with 40% of companies looking to increase both 100 and 150 tonne capacity models.

53.3% of companies have increased their rates for 50 tonne mobile cranes since last year.

53.3% of companies have increased their rates for 50 tonne mobile cranes since last year.

Even better with tower cranes, with 54.5% increase their rates for 100 tonne-metre models and well over half increasing rate for 150 tonne-metre rated models.

Fleet times

Fleet time utilisation was also included in our survey this year and the results suggest that most companies see it as stable and just under 40% believe it is improving. This means only 15% think it is deteriorating.

Why is the crane rental market increasing?

As this is a global survey, we invited respondents to offer their opinions on the current state of the crane rental market. Whilst very general, the below comments offer a taste of views at the coalface.

From Indonesia, “Due to increase in infrastructure spending and also the investment from private sector, 2023 should be a promising year.”

A perspective from Zimbabwe, “Crane rentals are on the rise due to increased mining activities. Especially the lithium mining activities in action really gave us a leverage here in Zimbabwe.”

Suggestions the market is struggling in smaller European countries as one responder from Poland said, “The tower crane market in Poland is very unstable, challenging.

“As for the market size there are too many small companies that are reacting swiftly for each and every economy downturn.”

A similar story is repeated from Finland, where a responder added, “In Finland, the market will go down 23-26% in comparison to 2022.

“This is due the Ukrainian war and confidence of both customers and the import-export industry. Also interest rate increases have an impact.

Finally, a USA responder saw some light at the end of the tunnel, commenting that, “the crane rental market is improving with higher utilisation and rates,” with another adding, “Business is very brisk across all sectors. Backlogs are strong and getting stronger.”

Fill out our survey form to voice your opinion and input on crane rental confidence.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.